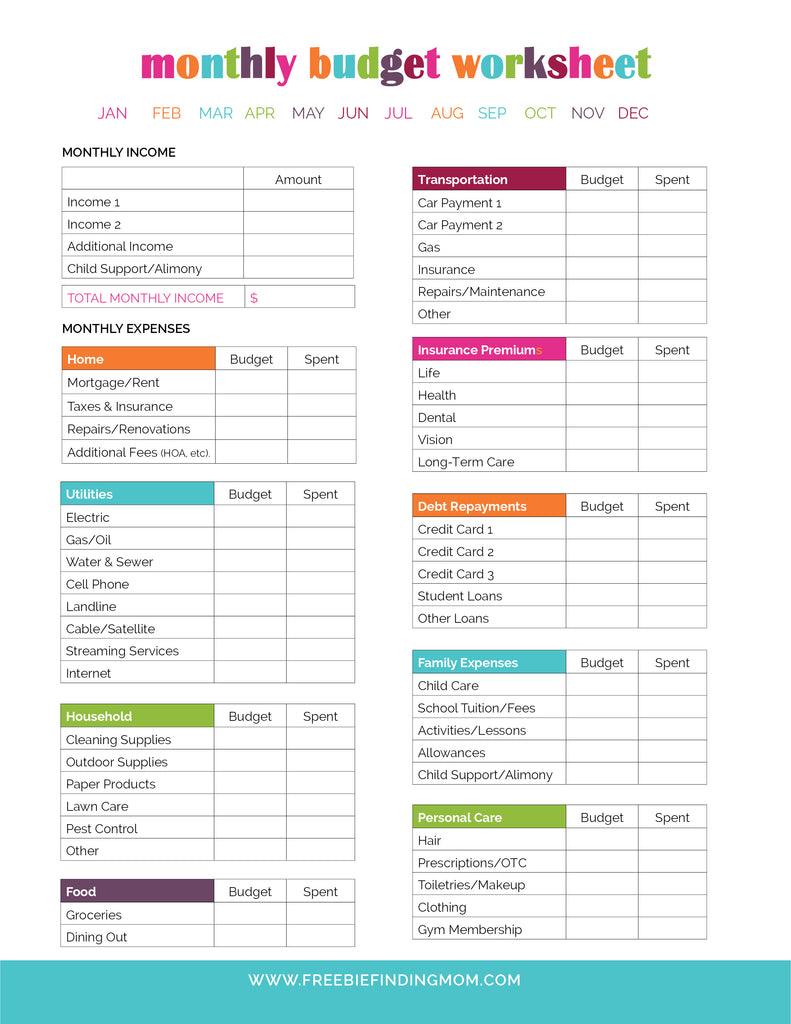

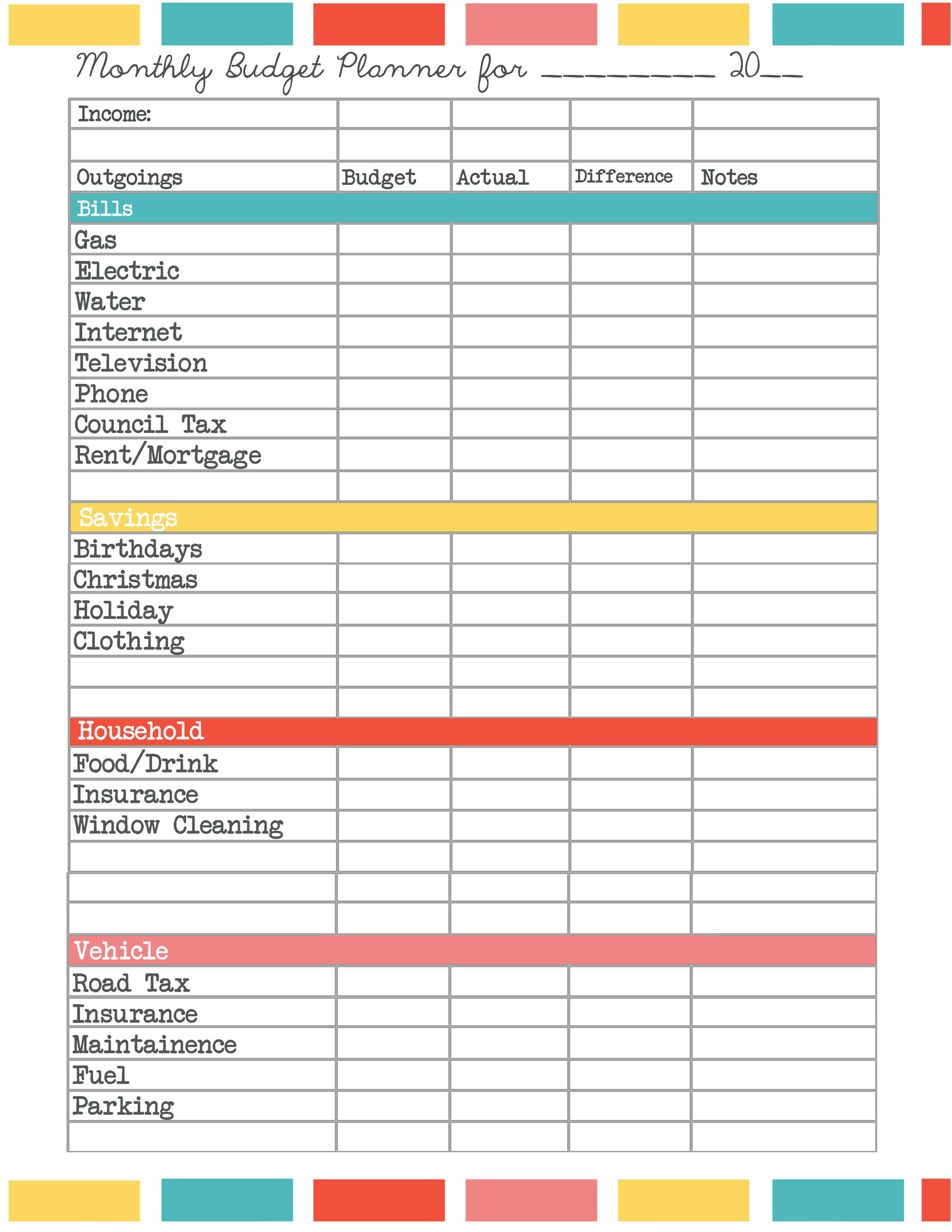

There are some instances that your expenses can be higher than your net income. In an article written by Tami Luhby entitled "It's Expensive to be Poor," which is posted in CNN Business, CNNMoney analysis of Bureau of Labor Statistics data found out that low-income Americans spend 182% of their annual income mostly on basic needs like food, housing, clothing, etc. It is especially hard to make ends meet if you are living in the metropolis since almost everything in this place would only work with money. Managing your monthly income to sustain your needs might be hard, especially if you are surrounded by establishments that entice you to buy. Having this type of document helps you manage your income and keeps you out of debt. This document is also used to create a budget plan for the succeeding month. Call 312.629.6600 to make an appointment.A budget worksheet is a document used to track how much money you have spent in a given period of time. Appointments are available upon request if you are planning a visit to SAIC.

BUDGET WORKSHEET FREE

Please feel free to visit the Student Financial Services office, Monday through Friday from 8:30 a.m. Our advisors are happy to assist you throughout the financial aid and payment process. * Must open with Acrobat Reader (or Acrobat) to activate the calculation function. Graduate Student Budget Worksheet - MFA Low Res - Summer.Post-Baccalaureate Certificate Student Budget Worksheet.These budgets will provide average estimates for indirect costs that you may wish to use for calculations other than 15 credit hours. You should use the worksheets in coordination with the Undergraduate Student Budget or Graduate Student Budget figures provided on the SAIC website. Please note that the indirect costs provided on the budgeting worksheets are estimated for an average 15 credit hour semester. Indirect Costs NoteĪverage estimated figures provided are for 15 credits per semester.

More information on payment plans can be found here.

Students may opt to pay their remaining balance after any financial aid resources, by enrolling in SAIC's deferred tuition payment plan for that term.

BUDGET WORKSHEET FULL

Payment in full or payment arrangements are due the 15th before each semester. If you need assistance determining your eligibility for additional loans, please contact an SFS Advisor. Please note if the student is living on-campus, your eligibility could vary based on your residence hall charges. The amount for which you may be eligible is listed on your financial aid award letter and is based on the number of credit hours and an average off-campus student budget. These loans are available to financially credit-worthy borrowers.

BUDGET WORKSHEET PLUS

If your current resources are not enough to cover your cost of attendance, you should seek additional funding resources.įor financial aid students, additional funding resources are most likely Federal Direct PLUS or private education loans if you have no other funding resources.

Upon completing the budgeting worksheet, you should be able to determine if your current resources will:

BUDGET WORKSHEET PDF

Use Adobe Acrobat to open PDF files and activate the calculation function. You should use the worksheet to determine your remaining costs after all available resources (scholarships, grants, loans, work-study and student, parent and/or other contributions) have been included. You may need to customize these indirect costs to meet your specific expected costs which may differ from the provided averages. You will need to choose from four possible living expense budgets to calculate your indirect costs. Indirect costs are costs for which you will need to budget, but will not be charged by SAIC. Direct costs are costs for which you will be billed by SAIC directly on the student's tuition and fees account. Use these electronic Figure Your Costs budgeting worksheets to calculate your direct and indirect costs. Budget Worksheet Instructions and Information

0 kommentar(er)

0 kommentar(er)